Transform your Contact Center operations and member experience with innovative identity solutions.

One of the things that separates Journey’s authentication solution is the wow factor for your members. Journey’s solution is first and foremost ultra-secure, but the ease and speed is what they will remember.

Zero Friction,

but High Security

Less Than 2 Seconds

to Authenticate

Journey enables composable authentication solutions with virtually no friction on your members. Your existing agents are freed up to help more customers than ever before.

Up to 1:Billion

Accuracy

Authenticate in Less

Than 2 Seconds

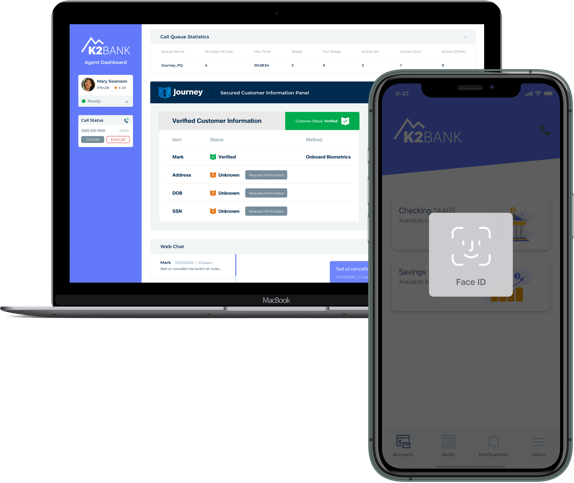

The Contact Center is now the number one vector for fraud in the enterprise, and much of that is based on vulnerabilities in identifying callers. With millions of agents working from home, having sensitive information on an agent’s screen in an unsecured location keeps many customer care leaders awake at night. Journey’s solution shows only what agents need to serve a member.

Eliminate Insider Attacks

Reduce Scope of Compliance

Journey has built an innovative platform and network that encrypts and verifies member information without actually revealing it to an agent. Journey’s approach takes the contact center tech stack out of of the scope of compliance.

Agents and Outsourcers Only See Pass/Fail

Member Info Remains Private and Secure

Watch President, Alex Shockley Give an Overview of Journey

Until now, Credit Unions have had to patch together suboptimal tools or processes to create new digital accounts for members and to authenticate members each time they call. Journey’s solutions leverage cutting edge cryptography and marries it with an easy and fast member experience from either a browser or a mobile app. This technology is easy to implement and can be launched in days or weeks.

The business benefits of solving for digital identity are enormous, and range from the hard savings of reducing fraud, call handling time, and abandon rates to simplifying your ability to let your agents work from home securely and easily, and much, much more.

We’d love to connect with you live to discuss the challenges your Credit Union faces. You might be amazed by the power of solving for digital identity in transforming how you interact with members and operate your contact centers.

KYC compliant onboarding for new and existing customers helps credit unions wow members and provide personalized self-service.

Verify member identity instantaneously across channels, with no passwords or PINs, so you can help your members faster and more efficiently, driving time and frustration out of this process.

Securely capture payment information, capture eSignatures, check ID documentation, all in the same session so your abandon rates plummet.