It’s imperative to establish trusted identity in any sensitive transaction. This is the foundation of secure, private, compliant, and smooth interactions between banks and your customers.

Journey takes a fundamentally new approach to establishing trusted identity that is faster, more secure and completely compliant with all security and privacy regulations.

Our Zero Knowledge Network™ is designed to provide up to 1:billion veracity of digital identity, ultra-secure transactions in every interaction, and an award-winning customer experience that drives digital adoption, establishes mutual trust and protects your business and customers from fraudsters.

In a highly-regulated industry like financial services, compliance is key. So what is the best way for a financial service company to control fraud and remain compliant with all banking regulations?

New account creation in Financial Services is a major fraud vector and regulated by strict regulations, making the process arduous for banks and customers alike.

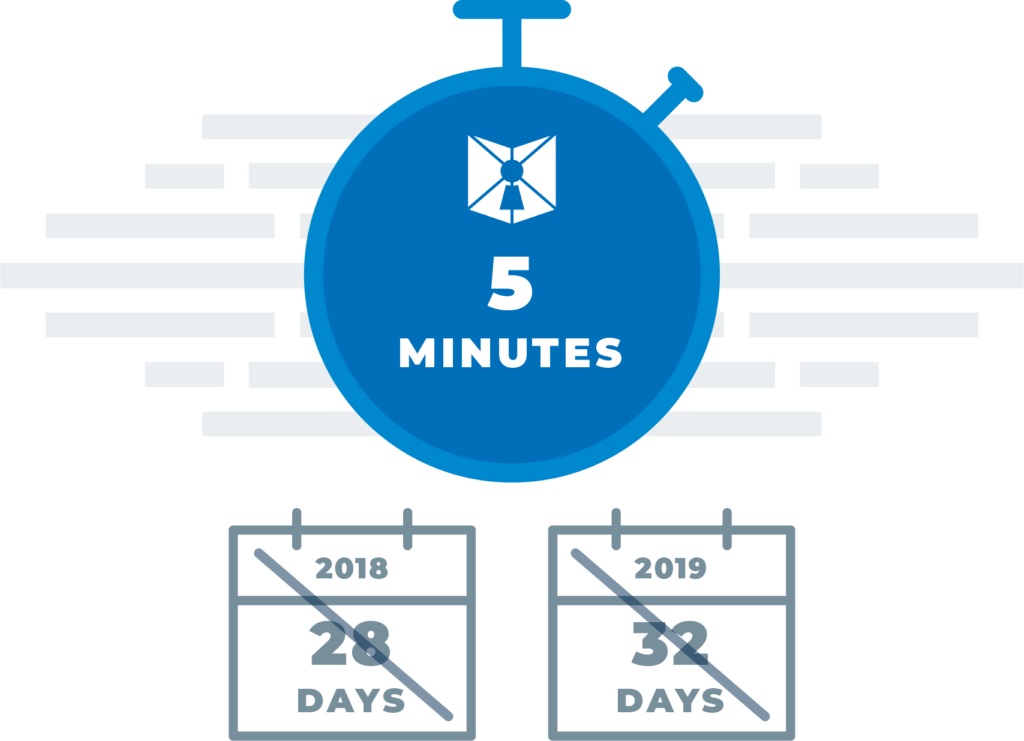

The typical time to onboard a new customer is now over 30 days, up from 28 days in 2018, and it takes 41 days on average to onboard a high-net worth customer. Journeys solution is far more secure than typical KYC processes and takes less than 5 minutes.

Journey makes this process simple, fast, elegant, and most importantly, ultra-secure, privacy-preserving, and compliant with all compliance laws globally, using our unique security features and Zero Knowledge™ financial services system.

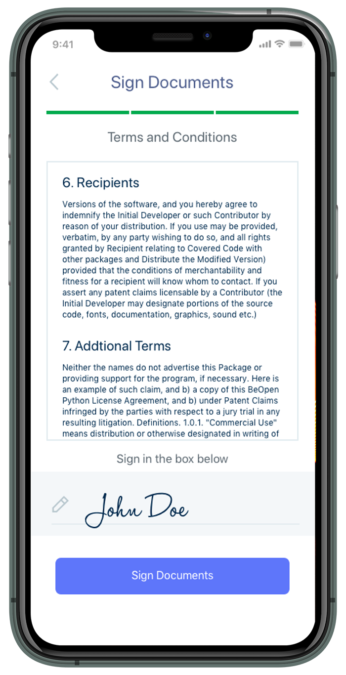

eSignatures have become a way of life, but typically still require the customer to take some action in another channel, such as eSigning a document in email. But what if there was a way to make them faster, easier, more secure, and seamlessly integrate them into the customer experience on a mobile device? Well, there is.

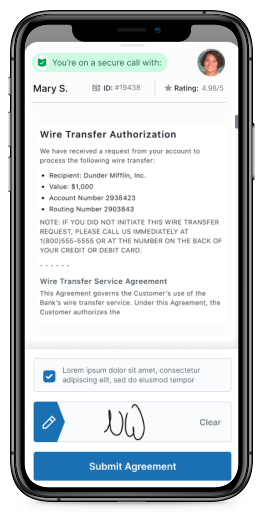

Wire fraud, stolen credit cards, hacked bank accounts, falsified tax returns – who doesn’t have a story these days of rampant financial fraud? Journey protects financial transactions with our advanced cryptographic techniques that individually encrypt and verify data without revealing it. This can be done quickly using the powerful sensors on mobile devices or laptops, modernizing both your customer experience and your security profile.

Wire Transfers are a risky transaction, so financial institutions have implemented a web of tools and processes to prevent it. The result has been a clunky customer experience that still permits too much fraud. Journey’s high veracity authentication and seamless secure transactions can drive fraud, time and friction out of the interaction. Click here to learn more.