How Wire Transfer Request Are Verified Today

Today’s clunky processes to avoid wire fraud result in huge inefficiencies and terrible customer experience. And with wire fraud growing each year, it’s time for a fresh approach.

Today’s clunky processes to avoid wire fraud result in huge inefficiencies and terrible customer experience. And with wire fraud growing each year, it’s time for a fresh approach.

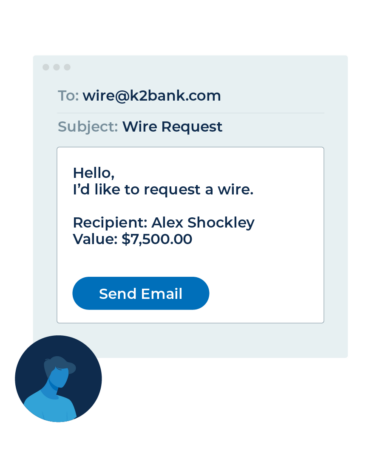

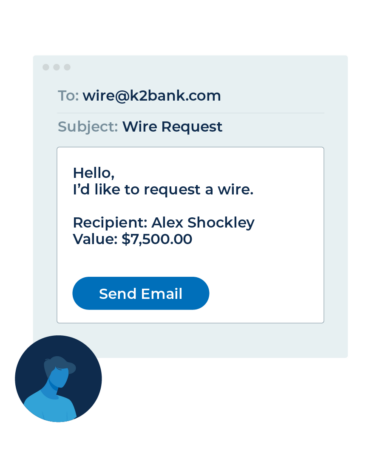

Customer emails wire request to the bank

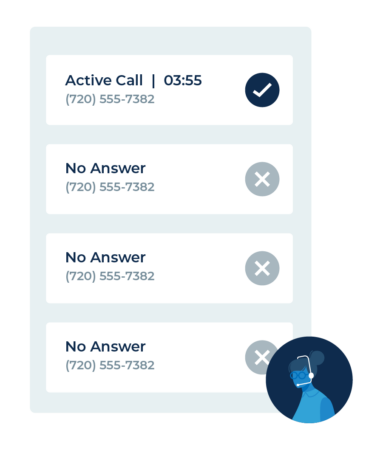

Agent calls customer to verify, again and again until they answer

Agent asks customer to repeat all of the details of the email, and to “authenticate” with a security question

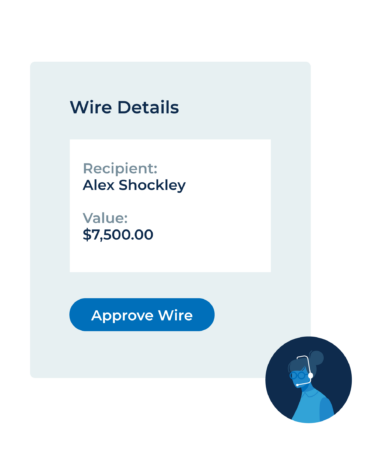

Agent makes decision to manually approves the wire request

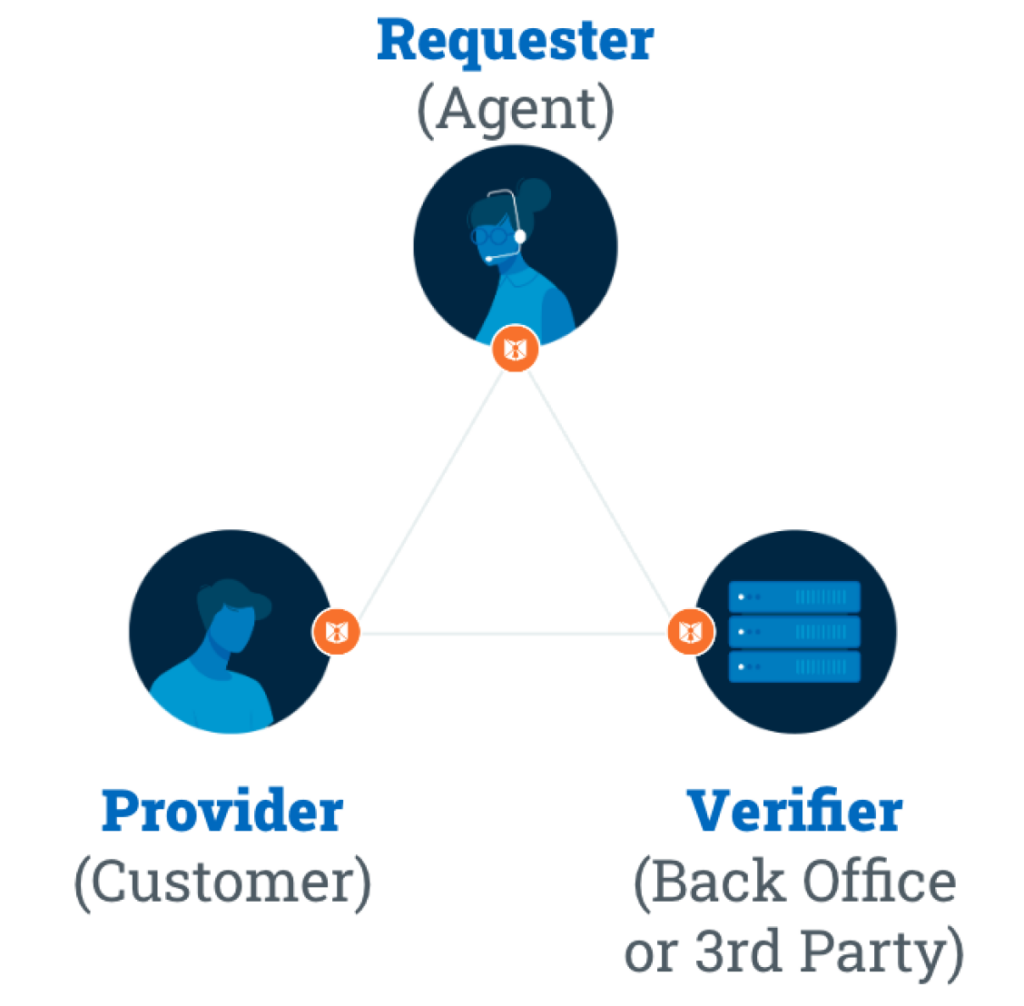

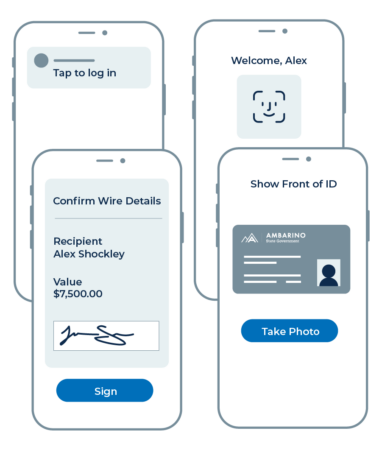

A simple customer interface, biometric identity proofing, and advanced encryption significantly improve security and speed of wire transfers.

Customer emails wire request to the bank

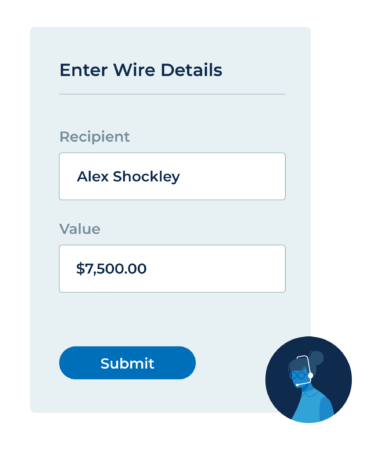

Agent enters the details into a Journey provided form

Customer receives the request to verify the request, authenticates biometrically, and if needed: scans ID

Agent sees the verification was approved and all necessary information was collected

Getting Started Quickly:

Deeper Integration: